Research

Benchmark Studies

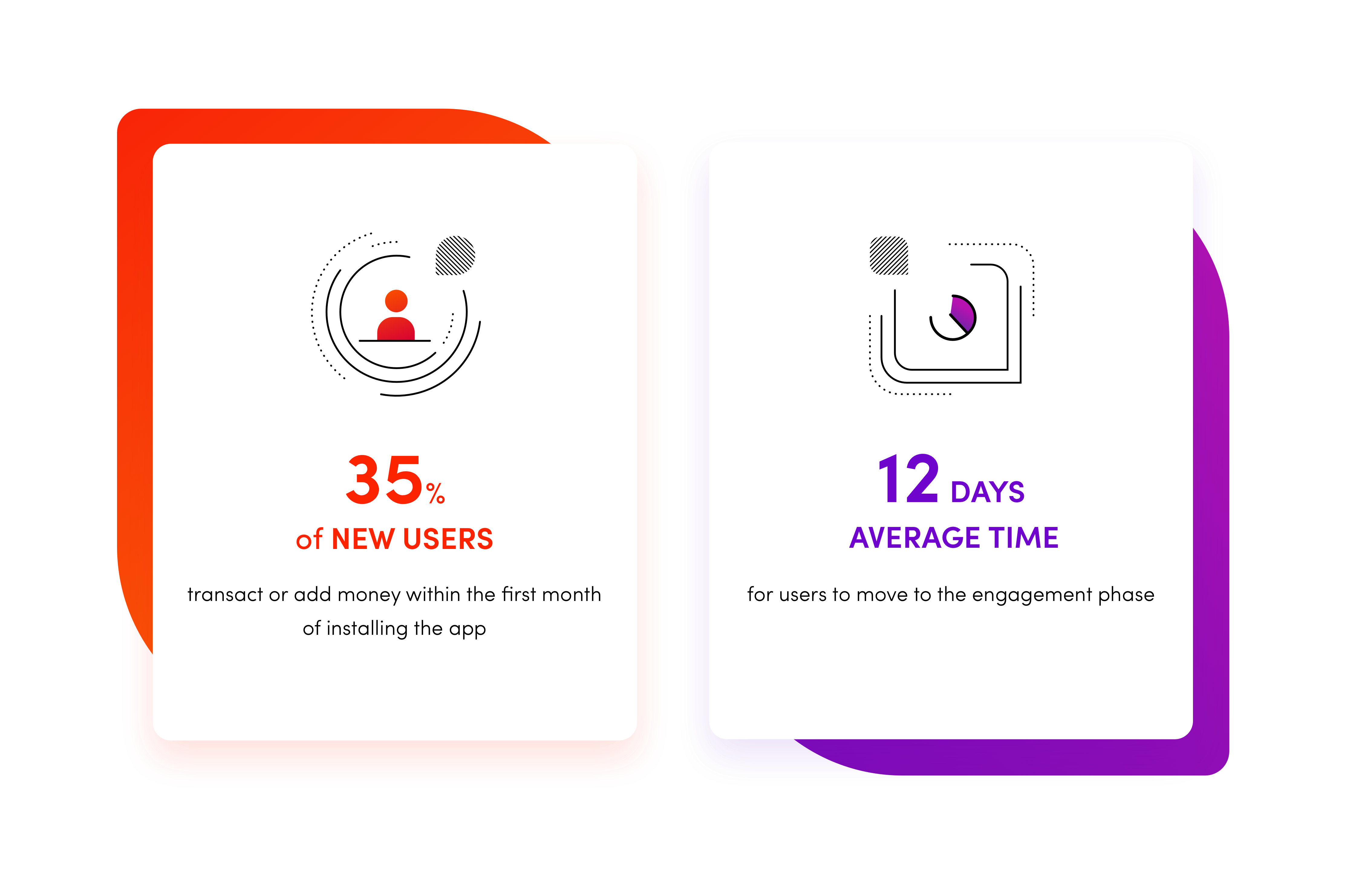

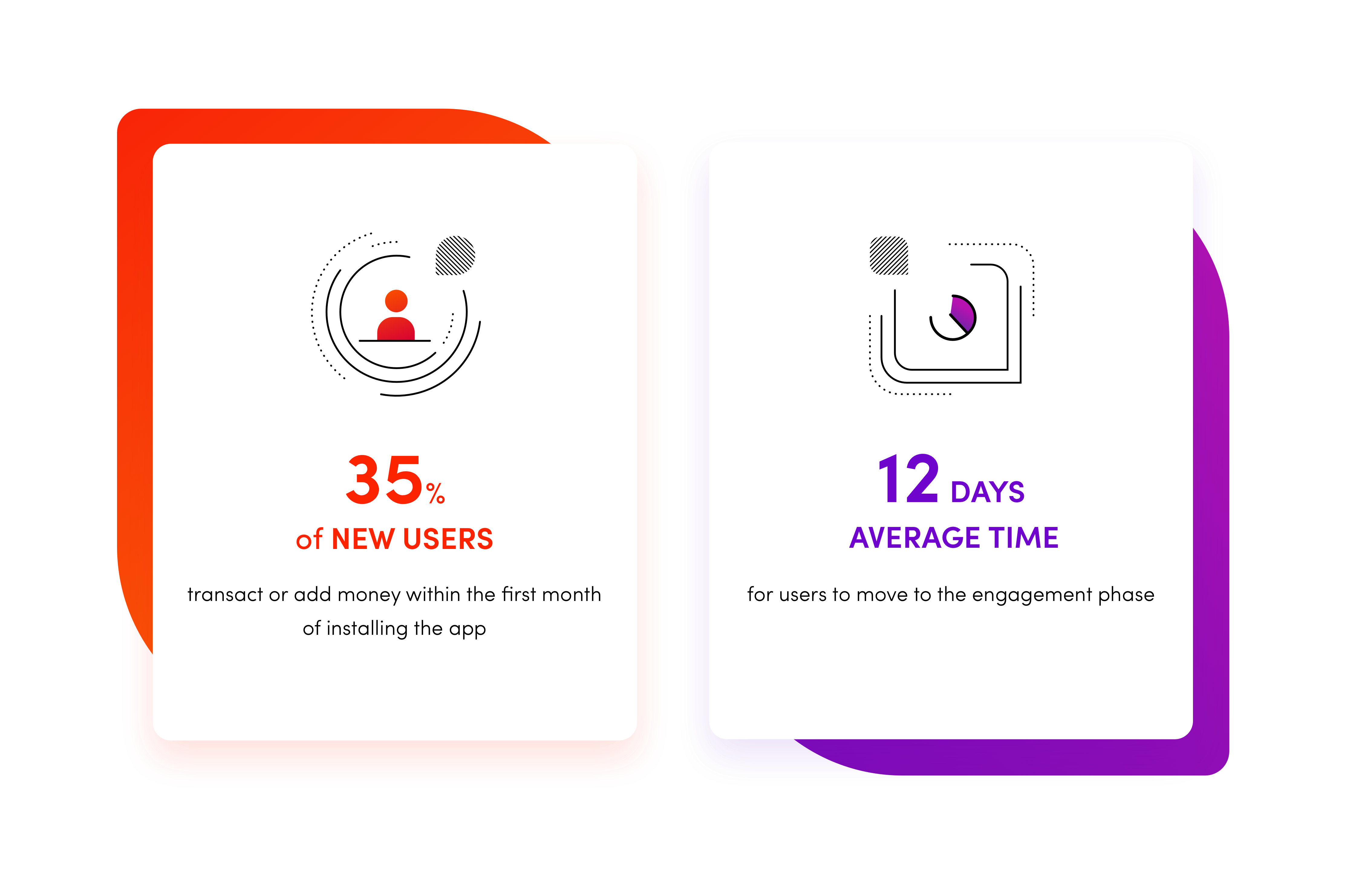

To understand why is onboarding experience crucial, I looked into industry report and similar products in the market. With the typical mobile app losing 77% of its DAUs within the first 3 days after installation, and 24% of all apps being used only once, it’s necessary to prove your app is valuable to a customer immediately.

Another thing about onboarding: user experience is critical, particularly in banking and finance. According to a recent Deloitte study, 38% of customers state that UX is the most important criterion when choosing a digital financial service. Additionally, 26% say that easy enrollment and login is the most important factor. Better onboarding could be the catalyst that quickens the transition from new user to transacting user.

User Testing

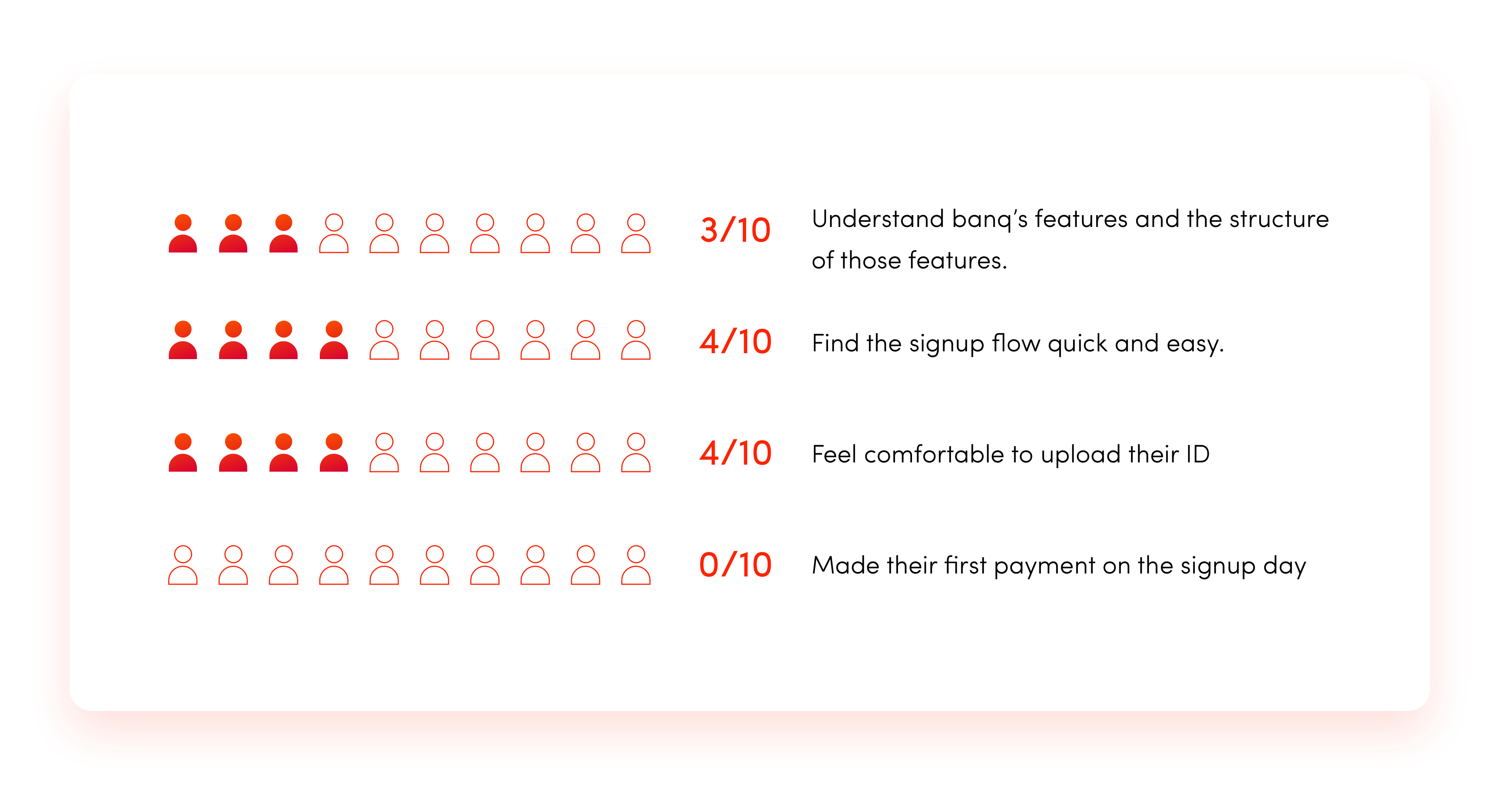

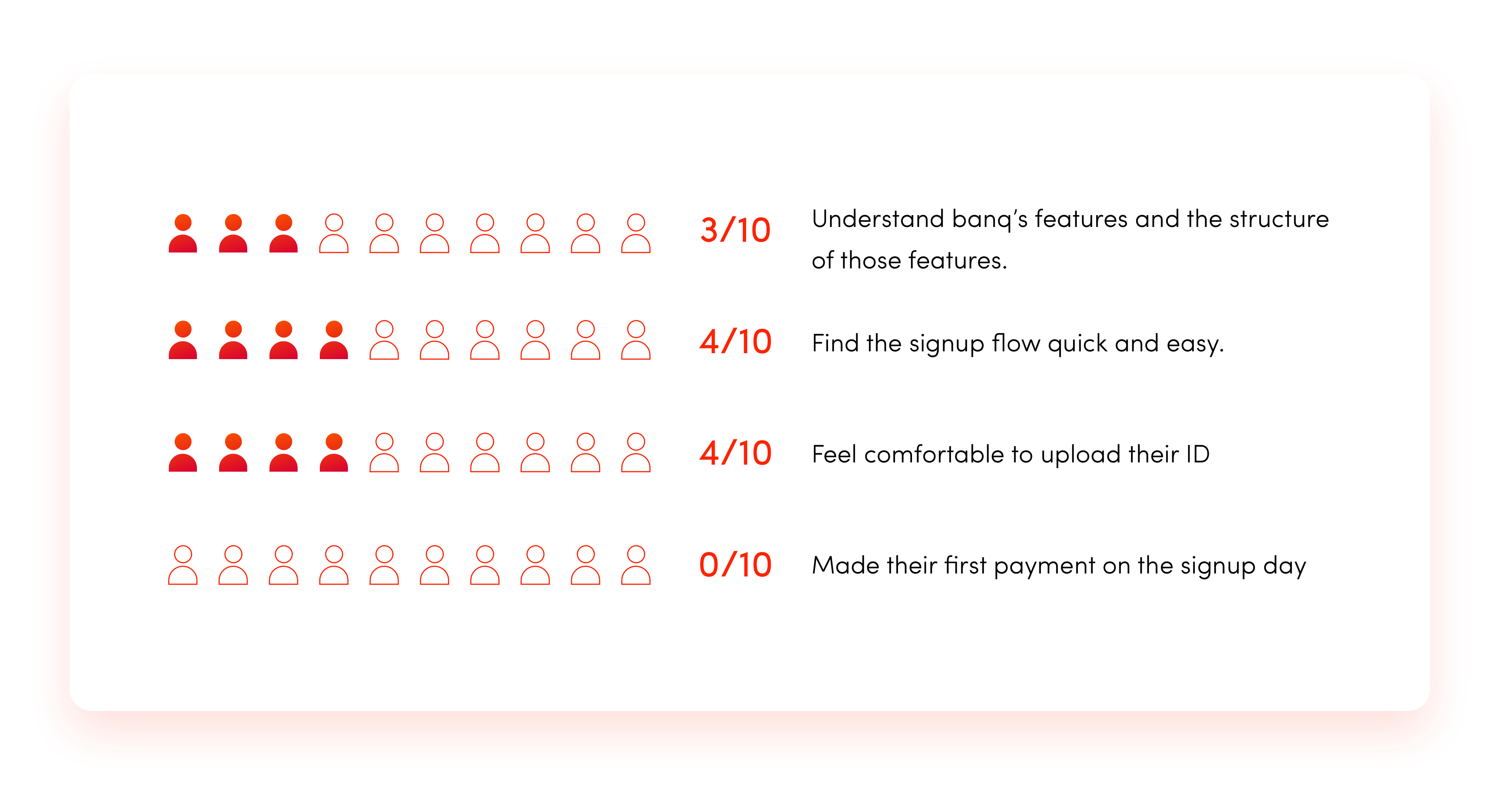

I conducted usability testing with 10 users with the goal to find out:

- What are people struggling with while using the current account creation flow?

- How can we build trust with customers?

- How can we better onboard new users?

Synthesis & Analysis

During the synthesis of our findings, I recognized some common pain points users experienced when using the current account creation flow.

Insights Generation

Onboarding is about retention, not acquisition. To determine the priorities, we did card sorting and organized user findings on an affinity map. I facilitated meetings and came up with three stages of user onboarding:

- Onboarding flow for new users

- Account creation flow

- Extended onboarding flow for new features

Solution

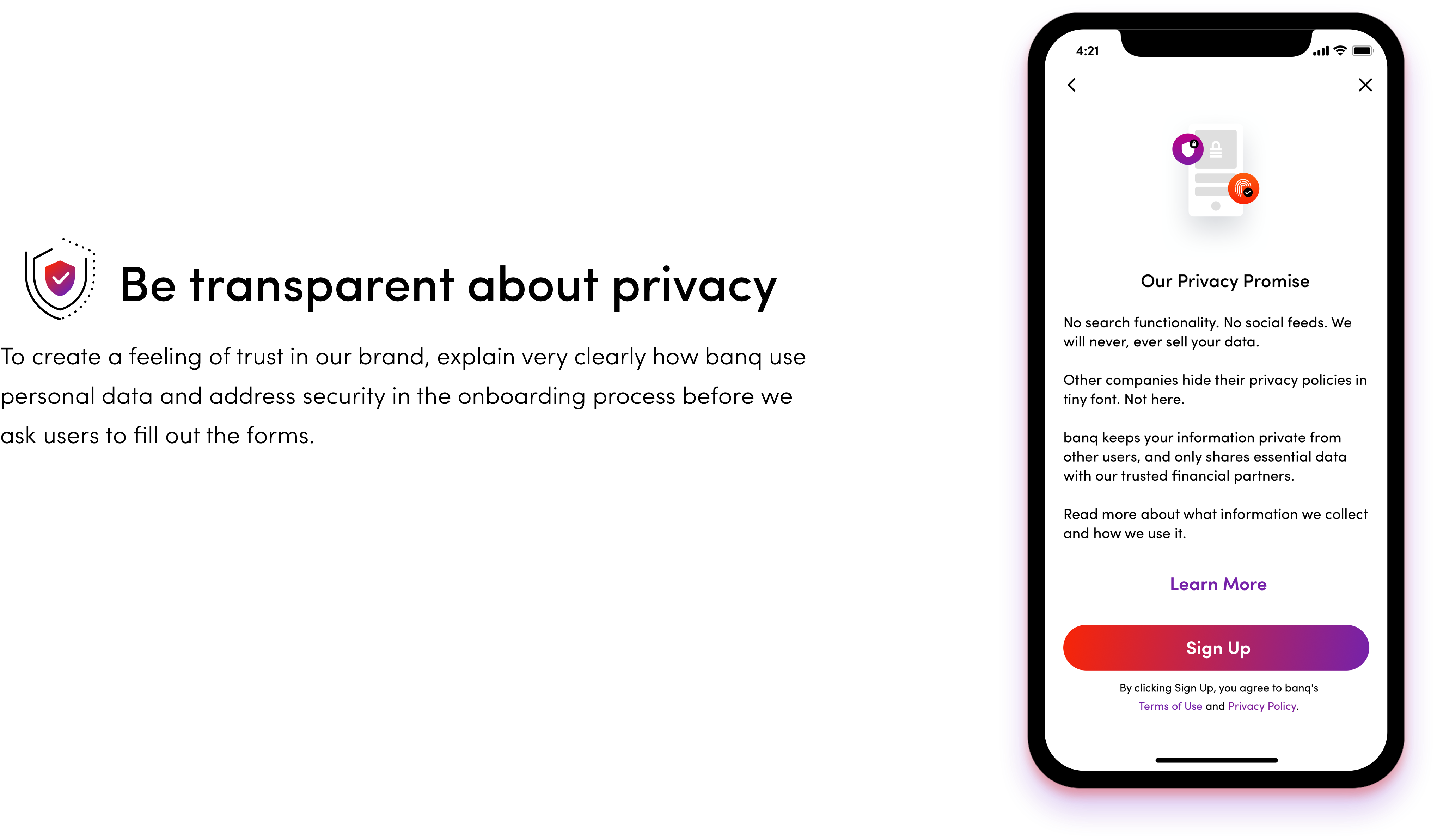

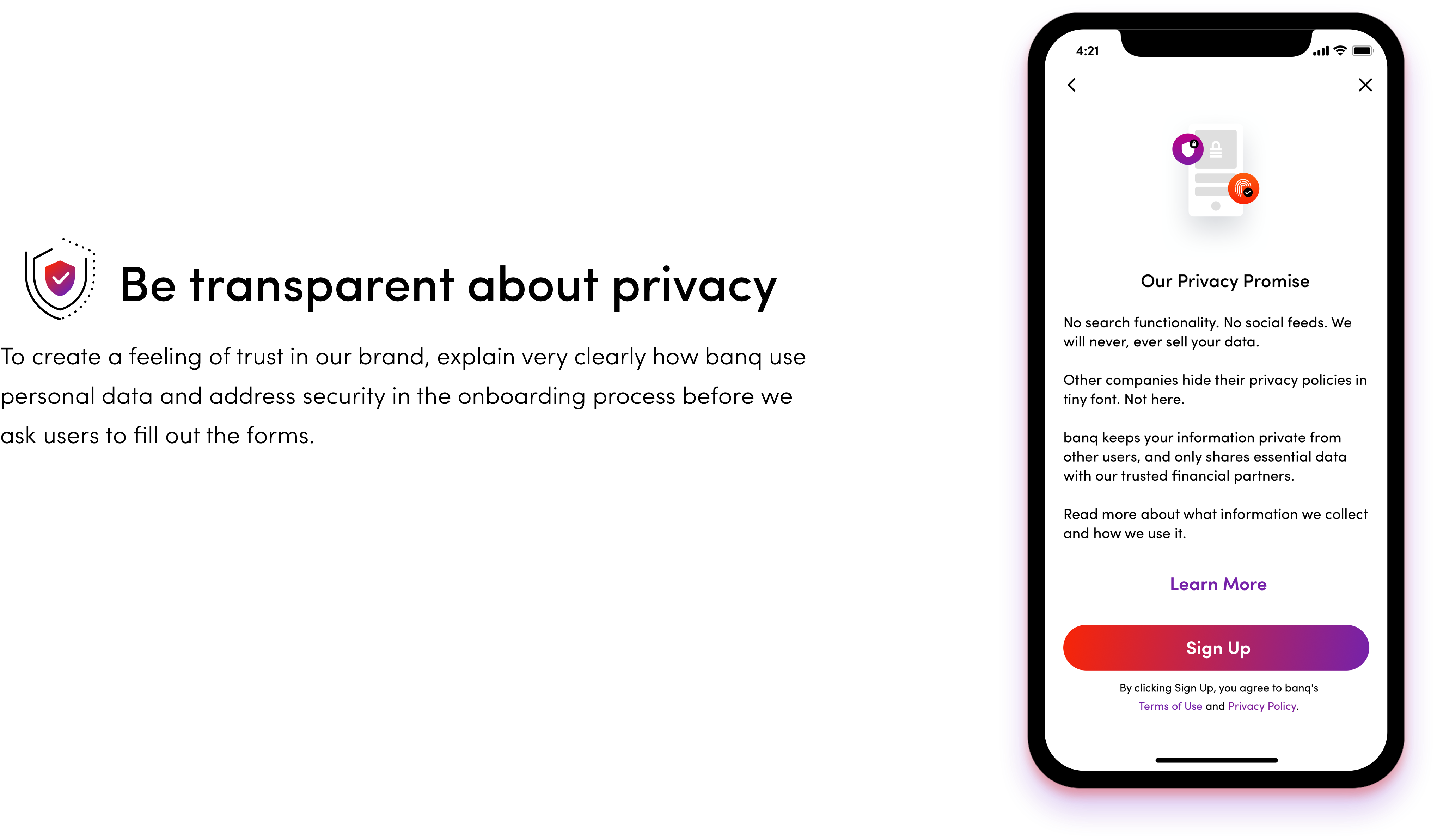

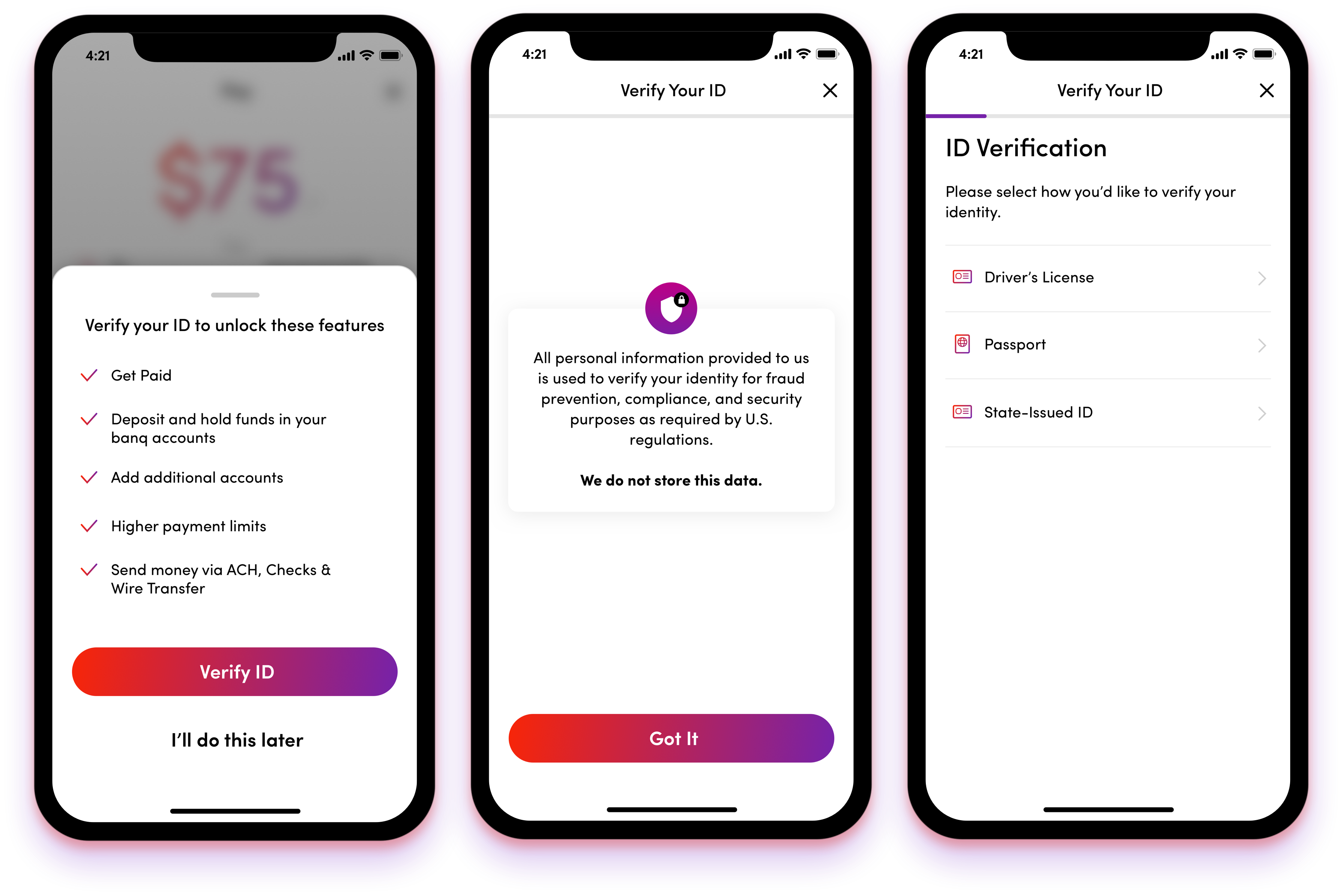

Establish Trust ASAP

The first and most important thing of onboarding is also the most logical: establish trust with user as soon as possible. Like all the fintech apps, banq operates under a ton of regulations and must collect information to comply with existing legal processes such as KYC (Know Your Customer) and anti-money laundering laws — all to ensure that our financial services are not being misused by malicious actors. But before users even get to register and use your services, they need to know that our app — in fact, our brand — is trustworthy.

As part of the registration process, every new user inevitably has to share personal information. Build up the trust even more by explaining what you’ll do with the info and how you intend to use it. Base on our research, realize that if a user has just heard about your brand and has just downloaded your app, they’re not particularly inclined to give out their personal information. Explain how banq will use this info and how their app experience will greatly improve with it, and they’ll be more open to sharing their details.

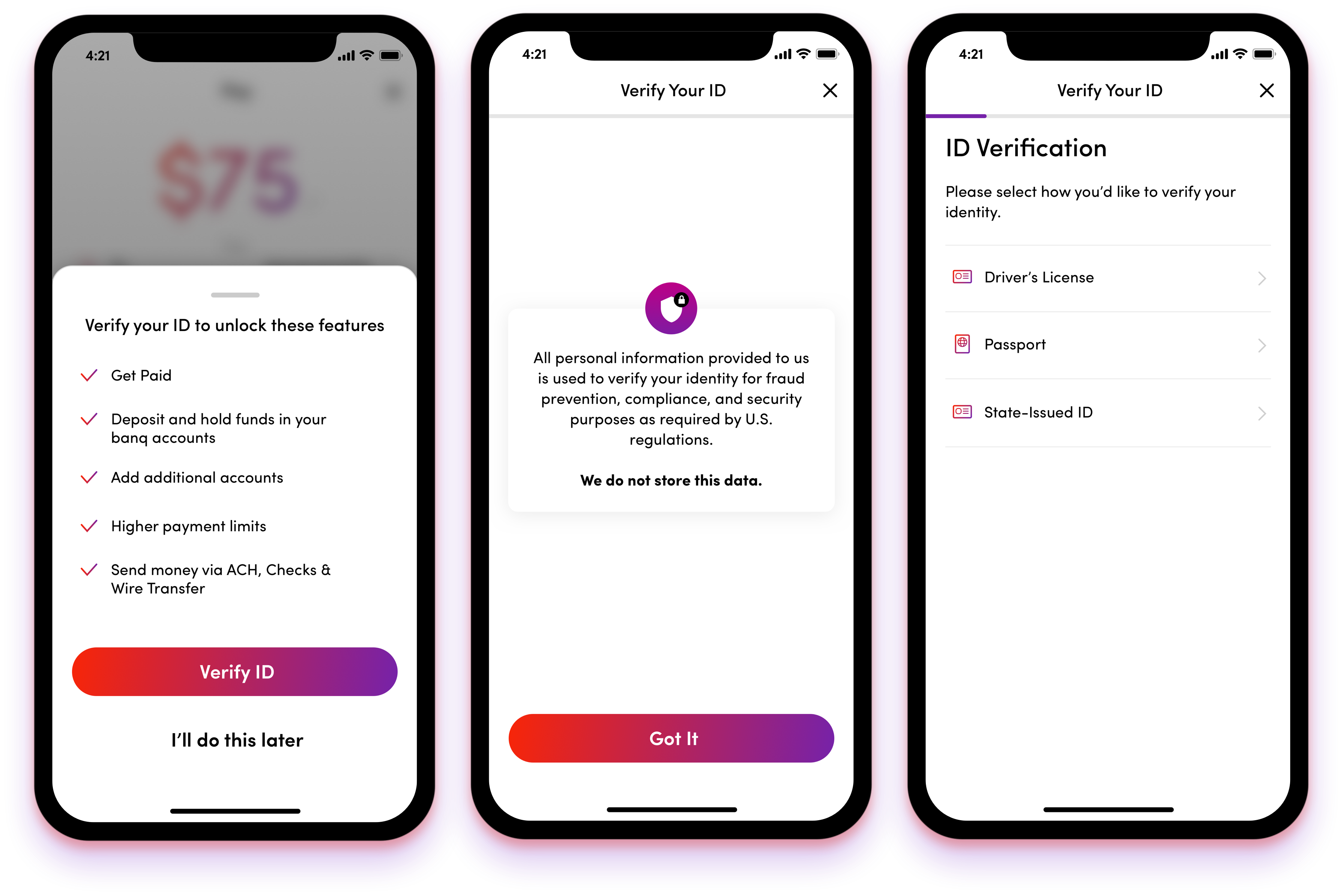

Let Users use it first

Allow users to use banq initially, with a minimal amount of data to pass KYC. Users can choose to gate some of the deeper functionalities later. In short, prove the value of banq first before asking them to put all the effort.

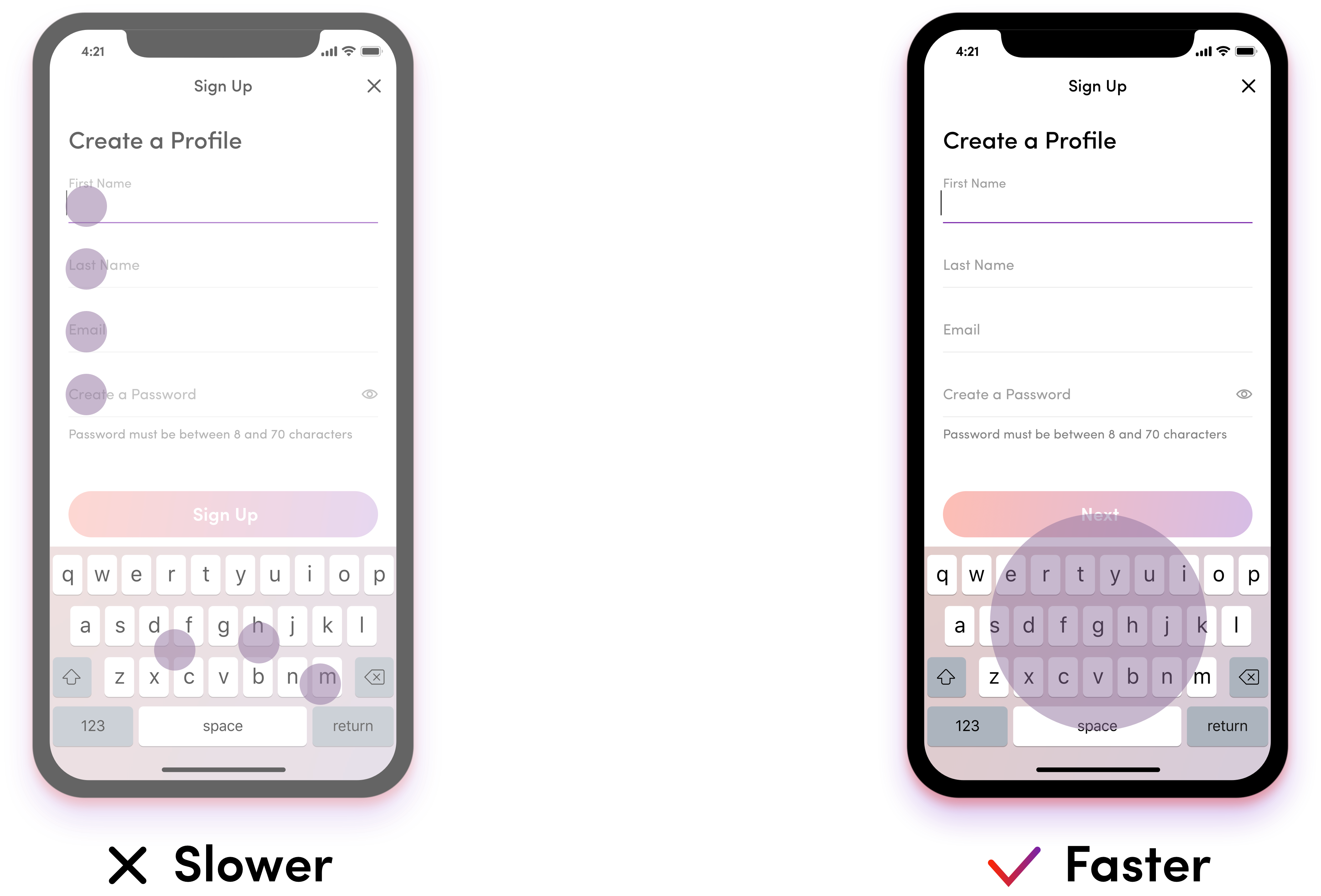

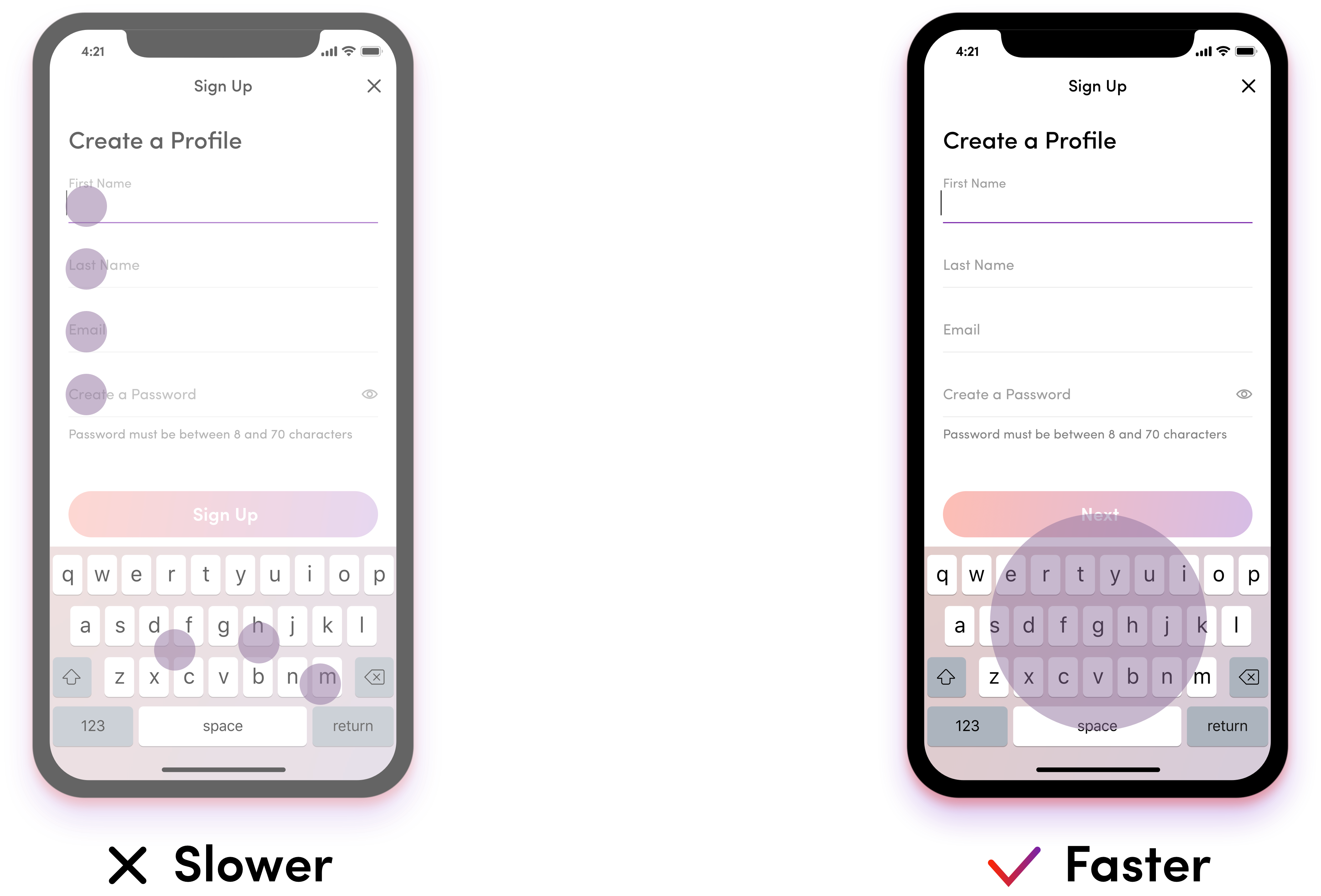

Build Easy-Peasy Forms

As part of the KYC process, banq new users will inevitably have to face a blank form. And we all know that people hate forms — primarily because they block people from getting things done, but also because, in the case of Fintech, they’re often incredibly tedious.

Instead of moving their fingers all over the screen, the autofill feature and sticky CTA button improve the UX when users facing inevitable forms.

Validation & After Thoughts

We conducted validation testing of the mobile and desktop clickable prototype with 10 users. Below is a summary of the findings:

Continue Onboarding Periodically

Onboarding is not necessarily a one-time thing. The more complex banq’s functionality, and the more new added features, the more banq should be educating users on what they can do. That ongoing education is still onboarding. It’s more than just the product tour or feature tour that happens at first launch